By selling the call, you’re receiving a premium, in which you’ll profit if the stock price doesn’t move much. If the stock price has a big move, you’ll still profit; however, you’ll have to give up your shares.

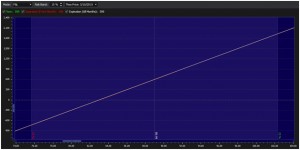

To get a clearer picture, let’s look at an example of one of the most popular (and many times effective) strategies that stock traders will use to begin learning how to trade options. Assume you were long 100 shares since March 13th, 2015 of Exxon Mobil Corporation (XOM) at the price of $83 per share. As of May 8, 2015, the stock price was trading at $88.99. Now, you’ve invested $8,300 and your profits are $599, which is an unrealized gain of 7%.

Your overall risk is now $8,899 – that’s what you could lose. However, it’s very unlikely that Exxon Mobil Corporation (XOM) would ever go to $0. After all, it is one of the largest publicly traded companies in the world. But, for some more speculative companies, there is always a chance that the worst-case scenario could occur. The upside is undefined; i.e, there is no limit to what you could theoretically make. For every $1 the stock price rises, you would make $100.

Conversely, for every $1 the stock price declines, you would lose $100. In mathematical terms, this is referred to as a linear relationship. In regards to flexibility … that’s it! If it goes up, you’ll make money … if it goes down, you’ll lose money.

Assume you believe that Exxon’s stock price has limited upside potential over the next month and you decide to “collect some premium” against your long position. Note, this is different to the dividend you would collect as an Exxon shareholder. This particular strategy is referred to as a “covered write” (if you buy the stock and sell the option at the same time) or “covered call” in generic terms.

You open up your trading platform and notice that (XOM) has options with a life-span of around 30 days. Then, look for call options that are above where the stock is trading. These options are referred to as “out-of-the-money.”

Assume the $89.50 calls have a premium of $1.18. Keep in mind, that an equity option controls 100 shares, so you would multiply the premium by 100. (which is equal to $118). By selling one $89.50 call contract, you’re collecting $118 in premium. In addition, you’re giving up your upside.

When you sell one call option contract, you have an obligation to deliver 100 shares of stock to the buyer of $89.50 call, if the stock price expires at least one penny above that price. Since, you’re long 100 shares, you don’t have undefined risk. Instead, you’d just have to give up your 100 shares if the options expire “in-the-money”.

You’ve given yourself some slight protection. For example, the stock price could drop $1.18 and you would not lose any money since you collected $1.18 from selling the call. However, if the stock price declines further than that, you would start to see some losses. As of today, we know that XOM declines further, but hind-sight is 20/20 and we can be happy to collect $1.18 to lower our cost basis and to turn the losing position into a later winner. By selling the call, you’re receiving a premium, in which you’ll profit if the stock price doesn’t move much.

If the stock price has a big move, you’ll still profit; however, you’ll have to give up your shares. In regards to the downside, you’ve got a $1.18 cushion, anything more than that, you’ll start losing money.

In return for all these benefits, we’ve given up our undefined profit potential. That is, our profit potential is capped off. Sure, it can seem complicated and overwhelming at first. However, when you’ve got someone like Brutus on your team, he’ll be able to do the heavy lifting for you.

He is able to tell you if options are relatively expensive or cheap. He’ll also be able to find the optimal balance between the best expiration date, downside protection, enhanced return, and probability of lost upside, based on your pre-set criteria. There would be no more guessing which option strike to select or which expiration period is optimal.

Heck, Brutus will even rank the best strategies based on your market opinion… it doesn’t get better than that!

Now we move on to part II of this article (below) where we explore the versatility of options and how they can be used to get a better return on your capital.

By selling the call, you’re receiving a premium, in which you’ll profit if the stock price doesn’t move much. If the stock price has a big move, you’ll still profit; however, you’ll have to give up your shares.

To recap, in Part 1 we discussed how options could be used as a tool for speculating and hedging. Options also offer the ability to leverage capital and better define risk. However, a lot of investors are fearful of trading options. They believe that they’re too complicated and risky.

Now, it is true that there is a learning curve involved before you can successfully start trading options. But we’ve reached a point with technology where that learning curve is not as steep as it once was.

You see, a lot of the guess work in selecting the right strategy, option strike, and expiration period. With the highest probability of success based on risk/reward is already done for you. When you decide to team up with Brutus, you have your very own quant who you could use for free.

We also went over a very simple strategy called a covered write, also referred to as a covered call at times. Basically, selling an out-of-the-money call against a stock we are long. The idea behind the strategy is that we believed that the underlying stock had limited upside. Therefore by selling the call we were able to collect a premium. This helped us a little if the stock price moved up to the strike price of the short call, stayed put or decreased a little.

Now, let’s get into more detail.

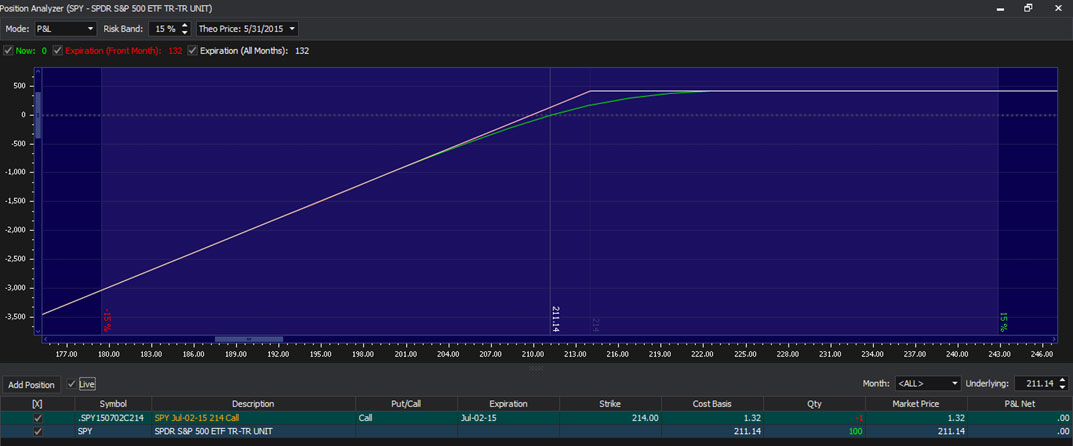

For example, let’s say you own 100 shares of the SPDR S&P 500 ETF Trust (SPY), an ETF that is supposed to track the performance of the S&P 500 Index.

One strategy is to sell out-of-the-money calls against your stock.

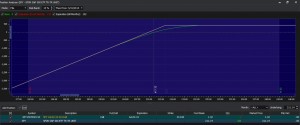

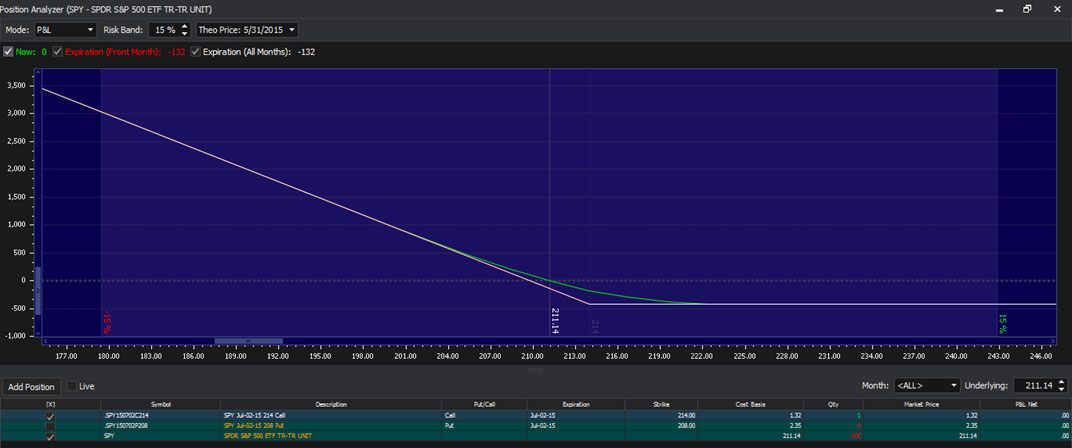

Now, by observing the risk graph, you can see that the profit potential is limited and the risk is substantial – limited to the amount you paid for the ETF.

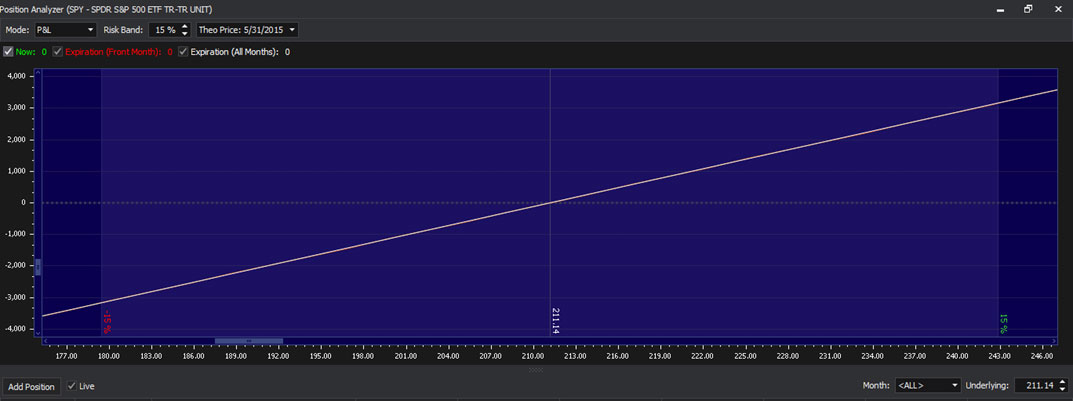

Let’s compare this against the risk graph of long SPY ETF shares.

However, when you’re long stock, the profit potential is also undefined. By selling the call against the stock position, you negate the undefined profit potential – so no getting filthy rich overnight as most like to promise on the internet. With that said, a long stock position has an embedded long call in it.

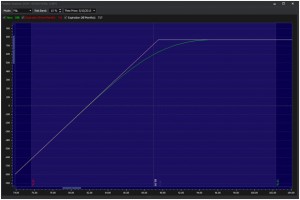

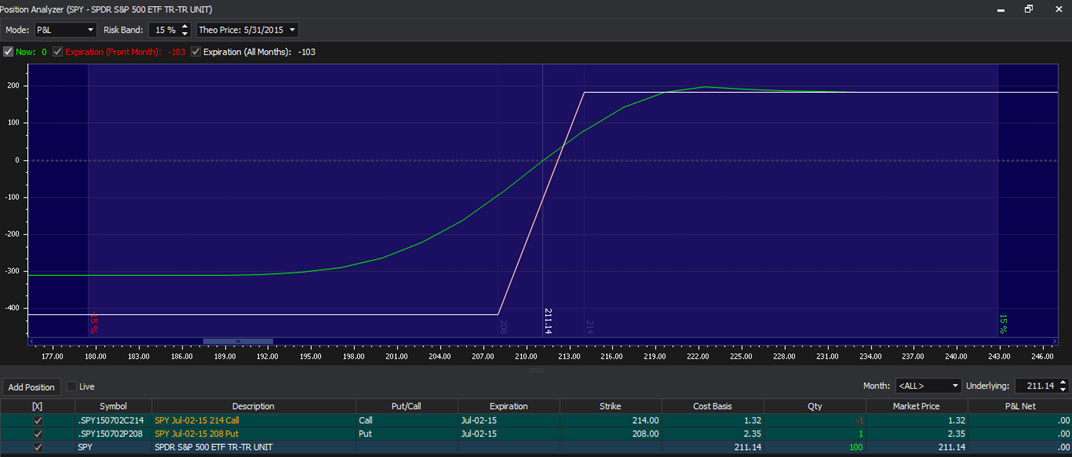

Going back to the covered write position, what if you were worried about the downside? Well, since you collected premium from selling a call, you could use some of those proceeds to buy downside protection. This can be achieved by buying a put option.

As you can see, the risk is now limited as well as the profit potential. This particular strategy is called a “bull collar” or simply “a collar / collared stock” … but as your knowledge of options improves, you’ll later find out that this same position can be replicated using a combination of puts or a combination of calls. With BRUTUS, you can swiftly switch in between strategies.

Bottom line … you can replicate a stock position with options and you can replicate option positions with other options or even a combination of options and stocks. Again, this isn’t to overwhelm you, but rather to show that “options” is not a dangerous product designed for gamblers and adrenaline junkies.

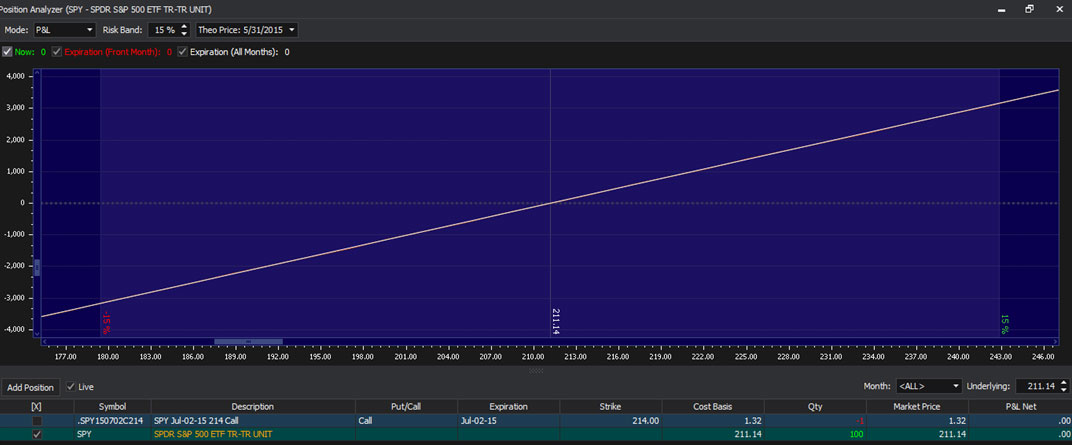

What if we didn’t feel like limiting our upside but still wanted to be hedged, in case the market had a correction just like what happened recently? By keeping the long stock position and keeping the long put, we have the equivalent of a long call.

A long stock position plus a long put = a synthetic long call position. In addition, we looked at the covered write earlier. That position is equivalent to being a short put. A long stock position + a short call = a synthetic short put position.

You see, a long stock position is equivalent to a long call and a short put (of the same strike). By observing the risk profile of a long stock position, you’ll see that it has the same properties of a long call and short put.

On the other hand, a short stock position is equivalent to a long put and short call (of the same strike).

Now, if we bought a call against a short stock position, it would be the equivalent of being a long put.

In conclusion, with options, you’re able to precisely express your view on the market and explicitly define your risk and profit potential while knowing the probability of each outcome at the time of trade entry. Not only can you make bets on market direction, you can also make bets on whether or not a stock will move a little … a lot … or not at all.

The demonstrations above were not meant to be trade recommendations … but were meant to show you a small sample of what you can do with options to build up tons of flexibility through synthetic positions. There are a number of strategies that can be applied and many ways you can exploit opportunities through the options market.

That’s where teaming up with a super quant like Brutus becomes so valuable. You don’t have to be a mathematician, a former market maker or an options expert to take advantage of the opportunities the options market has to offer. All you need is to have a few strategies that you’re comfortable to trade and Brutus will do all the heavy number crunching for you. Not only that, but he’ll rank every combination of options against the criteria in your strategy.

It certainly doesn’t get any more user-friendly than that!