Your Trading Preferences and Brutus

Your trading preferences establishes your level of risk, personalizes your trade criteria, and determines what type of options trader you are in The Brutus Options Ranker. This information helps both OptionAutomator and Brutus understand more about you as a trader to improve rankings over time.

You will be prompted to answer the following questions the first time you log into your account:

- What kind of trader are you?

- What is your risk appetite on capital?

- How can Brutus help you?

- What markets are you interested in trading?

You can also access the questions via your profile. You can do this to change your answers. For example, as you spend more time with the software you might want to change your trading focus or change your risk appetite on capital.

To access your preferences, click “Settings” in the left-hand panel on the home page. Next, select “Trading Preferences” from the sub-menu.

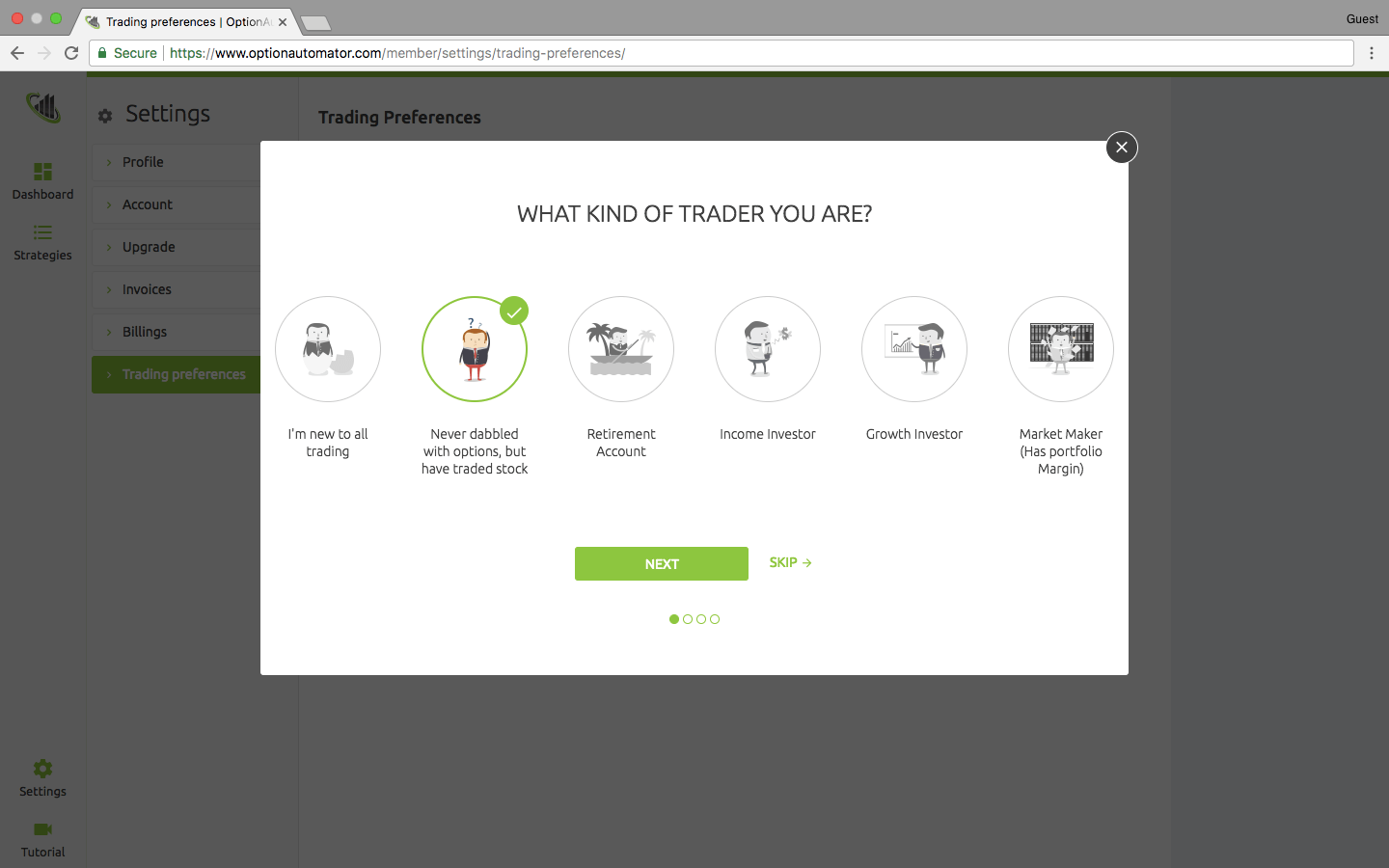

What Kind of Trader Are You?

This question will prompt you to make a selection based on your level of experience in options trading. Starting from left to right, indicate your level of experience from absolute beginner to both options as well as stock trading, to being a market maker. The names are supposed to be fun, so don’t get caught up in the categories. In short, the categories progress from novice to advanced with a few specific interests in the middle.

What is Your Risk Appetite on Capital?

You can answer this question by moving the slider to correspond with your risk level. The same slider is used with the Brutus Options Ranker when you are defining the tradeoffs between the criteria you’ve added to your strategy tree. As you move the slider to one extreme or the other you’ll notice the bars turn yellow and then red. This is to indicate that you are at the extreme end of the scale.

Important Notice: All types of trading involves a level of risk, including the possible loss of the principal amount you invested. If you choose less risk it means you place a high priority on preservation of capital and are a conservative investor. This does not mean that the trades found by the Brutus Option Ranker will be without risk.

In the case you move the slider away from neutral and closer to “Less Risk”, Brutus will consider alternatives that focus on safer trades to meet this outlook. To move in the direction of a more aggressive stance, shift the slider more to the right. Consequently the possibility of loss is greater, as is the potential reward.

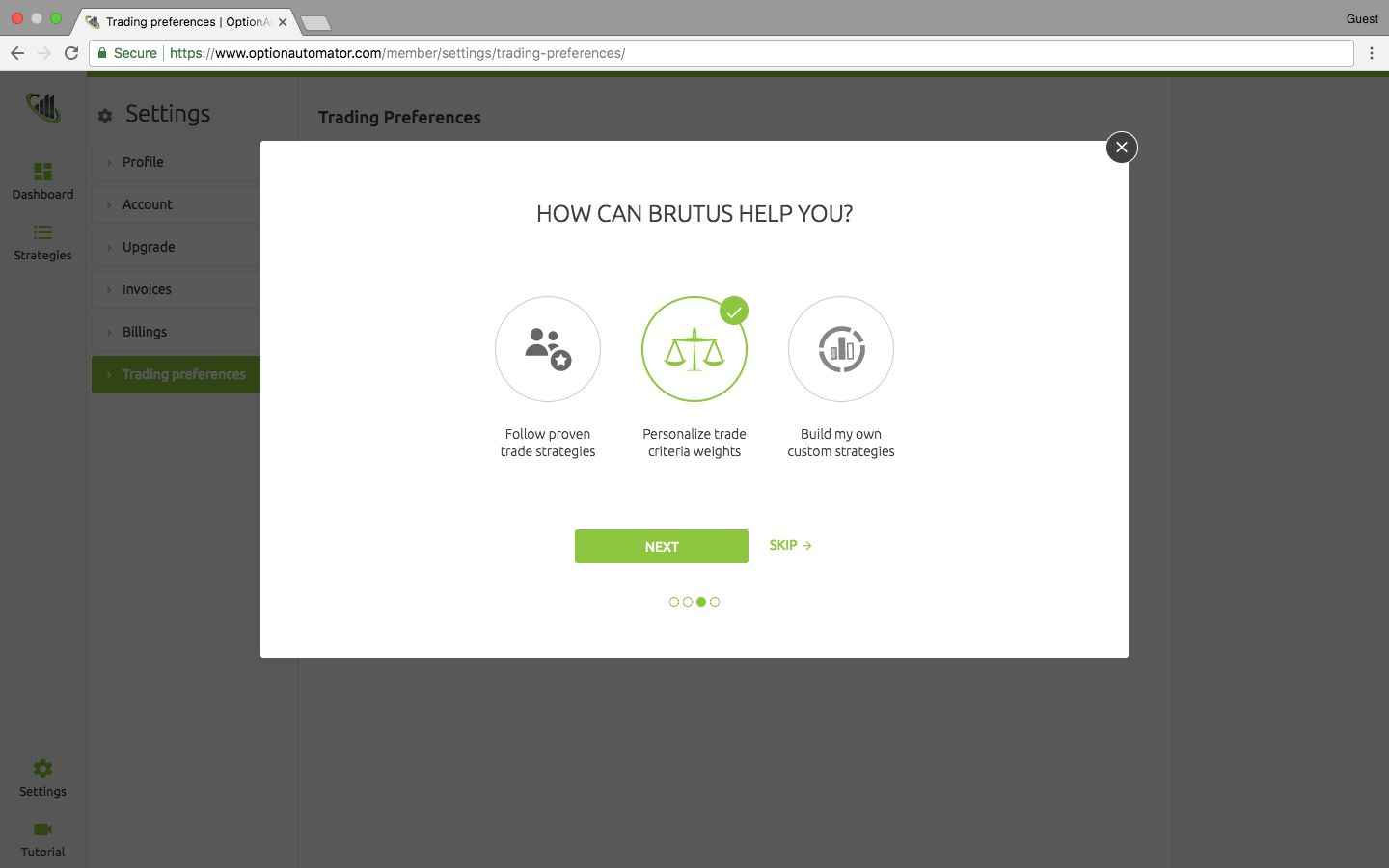

How Can Brutus Help You?

This question helps us understand how OptionAutomator user’s will use the software. The potential answers include:

- Use proven strategies native to the platform,

- personalize your trading criteria weights. or;

- build your own custom strategies.

This information isn’t used while ranking your strategies, but thank you in advance for this important feedback.

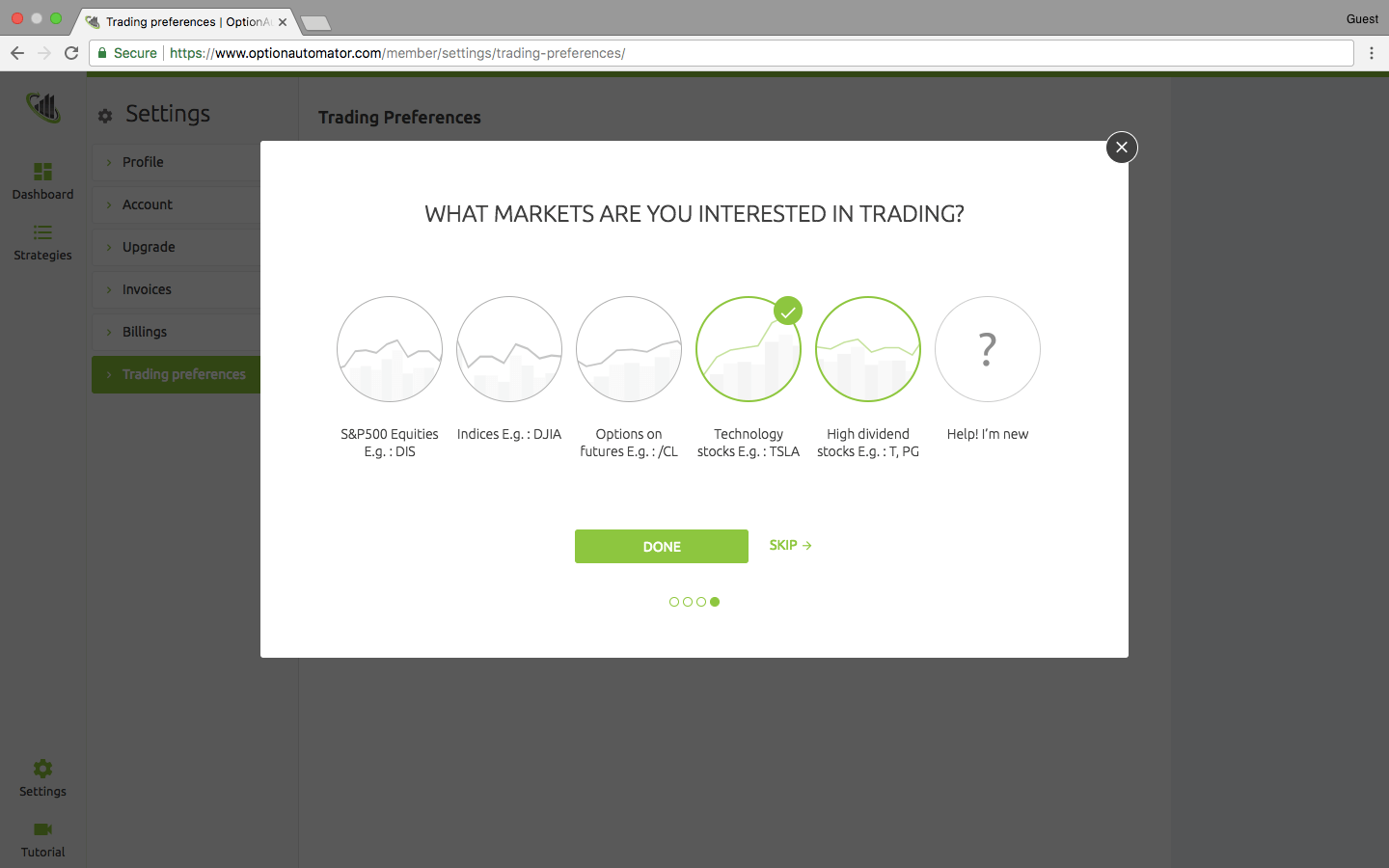

What Markets are You Interested in Trading?

Finally, the last question focuses on the types of stocks and ETFs you generally trade.

For example, an income-oriented investor may choose the ‘High Dividend’ choices. High Dividend choices are based on consistent dividend paying stocks, such as AT&T and Proctor & Gamble. Meanwhile, a person with a more aggressive profile may choose ‘Futures’ or ‘Technology’ in order to participate in growth.

If you’re new to trading, go ahead and answer “Help! I’m New”. This helps us understand our users and will keep Brutus neutral in rankings.

Note on Markets/Market Groups

A market group is a static or dynamically generated list of underlying stocks & ETFs used to generate options trading alternatives.

(For more information see our Knowledge Base article, “What is a Market Group?“)